ETFs: an added dimension to your investment choices

Starting in June 2017, our clients will be able to include Exchange-Traded Funds (ETFs) in the investment portfolios constructed through our office.

ETFs offer low-cost investment choices that are designed to enhance diversification, improve risk management and provide better risk-adjusted returns:

We are pleased to partner with three leading providers of ETFs:

- Vanguard Canada www.vanguardcanada.ca

- iShares by BlackRock www.ishares.ca

- Mackenzie Investments www.mackenzieinvestments.com/en/products/etfs

Click here for more information

What is an ETF?

Who is this for?

Those people:

- with investable assets of $250,000 or greater, and able to allocate $100,000 or greater to ETFs

- who are seeking core holdings at a lower cost to own than a mutual fund

- who want enhanced diversification, or access to a specific economic sector

- who seek superior performance with lower risk over reasonable periods of time

- who want to execute a range of strategic and tactical portfolio options

ETFs' Benefits for you

- Low costs

Management Expense Ratios (MERs) for ETFs tend to be significantly lower than mutual funds. Most ETFs do not pay trailing commissions.

Trading costs are usually lower, as the underlying securities are bought & sold less frequently than within a mutual fund. - Tax-efficiency

Tracking an index means that individual securities do not need be be sold unless the underlying index is changed or re-balanced - Flexibility through intra-day trading

Like stocks, ETFs may be traded at any time that the exchange is open. - Transparency

Since an ETF tracks an index, you know at all times what securities the ETF holds and in what proportion.

I already have mutual funds. Why should I add ETFs?

- To save money

- To participate in specialized sectors

- To broaden your diversification

- To avoid missing out on certain securities

- To achieve competitive returns over the long run

Who else says so?

A Hybrid approach

-passive vs. active

Why work with Sterling Rempel of Future Values Estate & Financial Planning?

- There for you, when you need us:

- Trusted advisor to 250 Canadian families

- 18 years of experience as an independent financial services firm, founded in 1999

- Accredited and award-winning financial expertise

- Registered & licensed in BC, AB, SK, MB & ON

- Comprehensive financial planning, encompassing:

- Cash flow & debt management

- Insurance & risk management

- Responsible investment accumulation

- Sustainable retirement income

- Tax efficiency

- Estate & legal considerations

- Available expertise

- Tax & estate planning advice with our legal expert

- Investment portfolio construction with our Chartered Financial Analyst

- Individual securities accommodation through our Qtrade Securities Specialist

- Full range of financial products

- Investment: ETFs, Mutual funds, segregated funds, GICs

- Insurance: life, disability, critical illness, long-term care

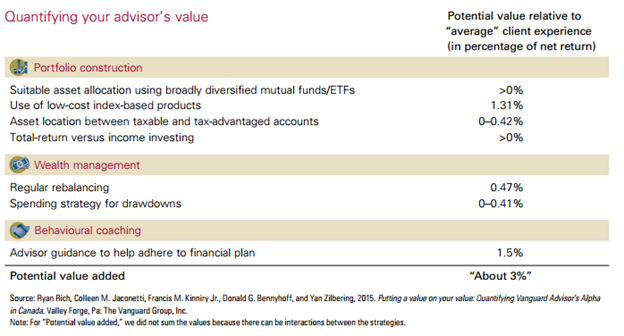

The value of advice

Recent Vanguard research shows that working with an advisor not only adds peace of mind, but also may add about 3 percentage points of value in net portfolio returns over time.

https://www.vanguardcanada.ca/documents/added-value-of-advisors.pdf

Save more, have more

- Advised households saved, on average, 10.8% annually compared to non-advised households who saved 6.7%*

- Have, on average, nearly four times more assets than those with no advisor*

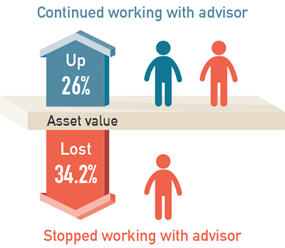

- Households who stopped using an advisor lost, on average, 34.2%of their assets while those working with advisors saw assets increase by 26%*

*Centre for Interuniversity Research and Analysis of Organizations (CIRANO), The Gamma Factor and the Value of Financial Advice, 2016

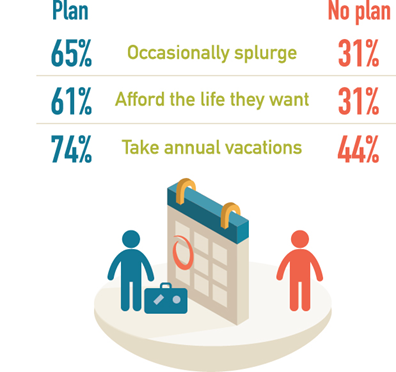

Households with a plan are more likely to:

- Have enough money to live the life they want (61% compared to 31% with no financial plan)*

- Be able to take an annual vacation (74%compared to 44% with no financial plan)*

- Have enough money for splurges (65% compared to 31% with no financial plan)*

*FPSC, The Value of Financial Planning, 2012

Learn more

- iShares by BlackRock Learning Centre

https://www.blackrock.com/ca/individual/en/learning-centre/etf-education... - Vanguard Canada ETF Education Centre

https://www.vanguardcanada.ca/individual/insights/etf-education-overview... - Mackenzie Exchange Traded Funds

https://www.mackenzieinvestments.com/en/products/etfs

Videos

- Vanguard ETF Video series

https://www.vanguardcanada.ca/individual/insights/etf-education-video.ht... - iShares ETFs 101

https://youtu.be/cZ9oRFQFrL4

Download

Contact Sterling Rempel today at 403.229.2123 or sterling@futurevalues.com

Book a meeting using our online calendar:

https://my.timetrade.com/book/G7JJK